Sodium Sulfate in 2025: Decoding Trends and Opportunities in Emerging Markets

Sodium sulfate (Na₂SO₄), a key industrial raw material, sees its demand closely track global industrial activity. By 2025, growth will vary significantly across Southeast Asia, Africa, Latin America, and the Middle East. This report analyzes consumption, trade, pricing, and applications in these regions to provide strategic insights.

1. Regional Demand: Divergent Growth Drivers

Southeast Asia leads global growth, with consumption expected to reach 250–300K tons at a CAGR of 6–7%. This is driven by the booming detergent and textile industries, fueled by manufacturing upgrades and rising urban consumption in Indonesia, Thailand, and Malaysia.

Africa, starting from a low base, holds significant potential. Consumption is estimated at 120–180K tons, growing at 3.5–4.5%. The market, concentrated in South Africa, Nigeria, and Kenya, is currently focused on detergents and glass, with demand from infrastructure and personal care sectors beginning to emerge.

Latin America shows steady growth, with consumption of 250–300K tons and annual growth of 3–4%. Demand is collectively driven by the detergent, paper, and glass industries in Brazil, Argentina, and Mexico, though potential risks from macroeconomic fluctuations require attention.

The Middle East sees moderate growth of 2–3%, with consumption of 180–230K tons. Saudi Arabia and the UAE dominate the market, where construction spurs glass demand and cleaning product consumption remains stable. Growth is closely tied to oil prices and government infrastructure investment.

2. Trade Dynamics: How Dependency Shapes Markets

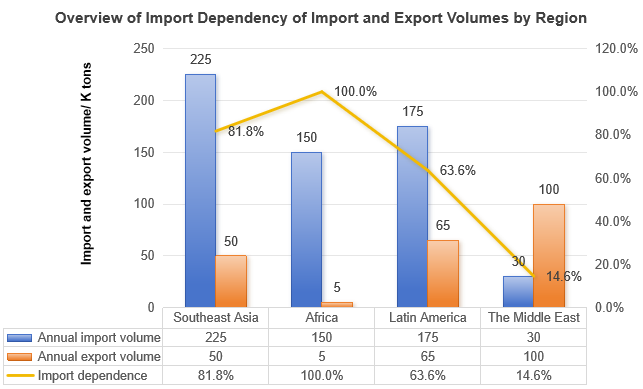

Southeast Asia is highly import-dependent (60-70%), primarily sourced from China. It imports 200-250K tons annually, while exports remain minimal at ~50K tons.

Africa is extremely import-reliant (80-85%), requiring 120-180K tons per year. Local production is very limited, resulting in negligible exports (<10K tons), primarily from South Africa to its neighbors.

Latin America remains a net importer despite strong local capacity in Brazil and Mexico. It imports 150-200K tons annually but leverages cost advantages to export 50-80K tons to the US and Europe, resulting in a net import volume of 70-120K tons for the region.

The Middle East is a key global net exporter with minimal import dependence (<10%). Using local by-products, it exports 80-120K tons, mainly to Africa and Southeast Asia, while importing a small volume (20-40K tons) for specific niche needs.

3. Pricing Dynamics: Navigating Cost and Logistics

Southeast Asia: CFR prices range from $160-190/ton, tracking China’s FOB export prices ($140-165/ton) and are highly sensitive to freight rate fluctuations.

Africa: CFR/CIF prices are among the world’s highest at $180-220/ton. This premium is driven by complex logistics, high insurance costs, and currency volatility, making the region reliant on imports from the Middle East and Asia.

Latin America: Local ex-works prices are stable at $150-175/ton. Strong domestic capacity in Brazil and Mexico cushions against global volatility, though international price trends remain an influential factor.

Middle East: As the global low-cost producer, FOB prices are benchmarked at $125-155/ton. This unmatched competitiveness is fueled by local by-product resources and energy advantages.

The above price forecasts assume normal shipping and exchange rate conditions. However, geopolitical events, extreme oil price volatility, or major policy shifts could cause prices to fall outside this range.

4. Industry Applications: Led by Detergents, Diverse Sectors

Detergents are the dominant application, accounting for 50-60% of total demand

Southeast Asia: Demand of 130-160K tons, growing at 4-5% annually, fueled by urbanization and rising consumer spending on daily chemicals.

Latin America: A mature market with demand of 120-150K tons and steady growth.

Textiles are a key growth engine and the second-largest application in Southeast Asia, with demand of 50-70K tons and a 6-7% growth rate. This expansion is driven by global supply chain shifts and local manufacturing upgrades. In other regions, this sector accounts for less than 10% of demand.

Glass is a core demand source in the Middle East, constituting 20-25% (40-60K tons) of consumption and directly benefiting from a construction and infrastructure boom. It is also a stable sector in Latin America and other regions, accounting for 10-15% of demand.

Pulp & Paper represents complementary, steady demand, generally making up 5-10% of consumption and growing 1-3% annually. Latin America (e.g., Brazil, Chile), with its developed pulp industry, is a region of relatively higher demand in this sector.

5. Strategic Outlook: Conclusions and Opportunities

Southeast Asia stands out as the global growth leader. However, heavy import dependence makes it highly vulnerable to cost fluctuations in China and spikes in international freight rates, creating significant price risk.

Africa’s potential is driven by its demographic dividend and ongoing urbanization. Yet, this promise is tempered by a weak industrial base, high logistics costs, and complex trade barriers, demanding robust risk management from any market entrant.

Latin America boasts the healthiest market structure, where domestic production and imports create stable, predictable growth. Opportunity lies in the regional imbalance— leveraging capacity in Brazil and Mexico to meet demand in neighboring countries.

The Middle East, with its superior energy and resource costs, is cemented as the global low-cost export hub. Its FOB prices are the global benchmark, and it is poised to supply the rapid growth in Africa and Southeast Asia.

Future growth will extend beyond traditional industries. In the short-to-medium term, green cleaning technology offers a steady growth path, fueled by stricter environmental regulations. For the long term, the maturation of the sodium-ion battery market presents a potentially transformative demand source for sodium sulfate, representing a critical variable for strategic monitoring