The Soda Ash Market Shift: From Demand-Driven to Cost-Driven

Soda ash (Na₂CO₃), a fundamental industrial chemical, is vital to the manufacture of glass, detergents, inorganic salts, and lithium batteries. But what is the current state of the soda ash market? What factors will drive its future price? This article delves into these questions, providing a comprehensive market analysis that covers the industry overview, short-term volatility, and long-term trends.

1.Overview of the Soda Ash Market in China

As the world’s largest producer and consumer of sodium carbonate, China’s market dynamics are essential for understanding the global landscape. In recent years, the defining trend in China’s sodium carbonate market has been its rapid shift from a ‘policy and demand-driven’ boom to an ‘overcapacity-driven’ surplus. Consequently, the core challenge has evolved from questioning the strength of demand to grappling with the reality of excessive supply.

2.In-depth Analysis of Soda Ash Market

2.1 Supply-side analysis

Production processes

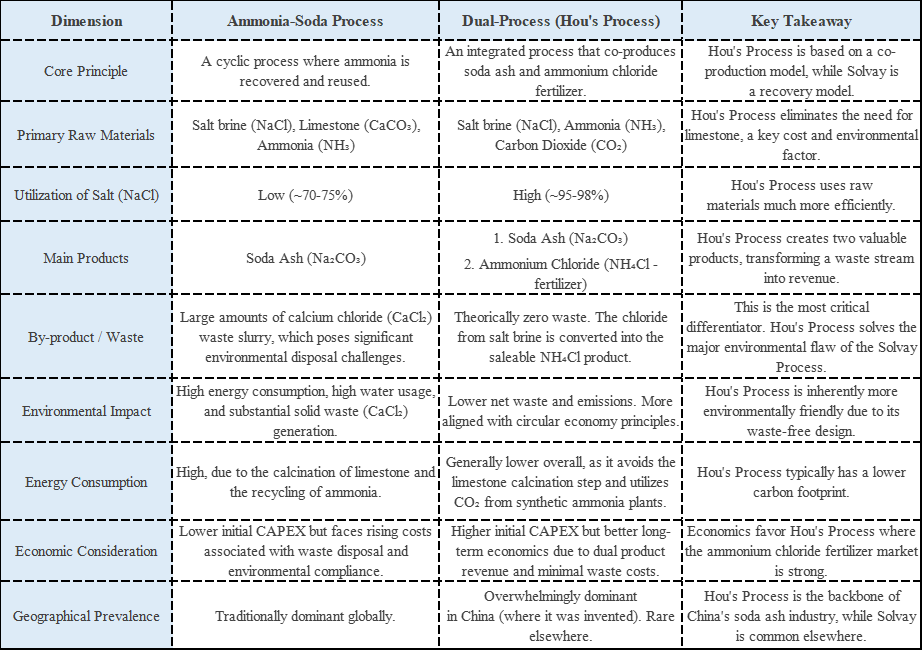

The two primary production methods—the ammonia-soda process and the dual-process (Hou’s process)—differ significantly in their cost structures, environmental impact, and exposure to policy restrictions, with the former facing particularly stringent environmental pressures.

Production Capacity and Utilization Rate

By 2025, the disodium carbonate industry will still be in a capacity expansion cycle. New capacity will continue to come online, with total annual capacity expected to surpass 40 million tons. Although high-cost facilities (especially some ammonia-soda process units) may be forced to suspend or reduce production due to financial losses, the growing share of low-cost processes (particularly natural soda process) and the overall expansion of capacity will significantly intensify market oversupply pressure.

Cost Analysis

The decline in prices of key raw materials—coal and raw salt—has shifted the cost curve downward for disodium carbonate production. The cost support level for the ammonia-soda process is now expected to drop to around RMB 1,100-1,150 per ton. This decrease in costs implies a lower price floor and creates more room for soda ash prices to fall.

Policies and Environmental Protection

In the short term, the implementation of these policies will accelerate the exit of outdated production capacity, potentially causing regional supply shortages and price fluctuations. Many small and medium-sized enterprises, along with those failing to meet environmental standards, will face intense survival pressure.

In the long run, the policies will guide the industry toward consolidation, green transformation, and higher efficiency. Leading companies with advantages in technology, capital, and resources are expected to further expand their market share, thereby increasing industry concentration and overall competitiveness.

The policies explicitly favor low-carbon and environmentally friendly natural soda processes and encourage upgrades to advanced synthetic methods. In contrast, energy-intensive and highly polluting ammonia-soda plants will face the toughest challenges, and their market share is expected to gradually diminish.

Under the stringent “dual-carbon” targets and energy consumption controls, this supply-side reform in the carbonic acid disodium salt industry represents an inevitable and profound transformation that will reshape the competitive landscape and its underlying dynamics.

2.2 Demand-side analysis

Weak demand for soda ash

The demand for soda ash is mainly influenced by the glass industry.

Float glass

Due to the decline in real estate completions, float glass manufacturers are incurring heavy losses and operating at low daily melting volumes. Consequently, their demand for soda ash (sodium carbonate) remains weak.

Although the daily production volume of photovoltaic glass has seen a modest recovery since early 2025, the global PV industry chain is grappling with overcapacity. Moreover, the growth rate of new PV installations is expected to slow (with domestic growth potentially falling to around 10%), compounded by challenges such as grid connection difficulties and declining electricity prices. This makes it unlikely that the sector will replicate the high growth of previous years. As a result, the demand pull for industrial soda is likely to be weaker than initially expected.

The demand for light soda ash still has support

The downstream market for light industrial soda is more fragmented and tied to daily consumer goods, so it is less impacted by the real estate downturn. While some segments are still seeing demand growth, it is unlikely to be enough to fully offset the decline in demand for heavy industrial soda.

3.Price and Future Trend Prediction of the Soda Ash Market

Throughout the year, the market is expected to oscillate with a downward shift in the center of gravity

Due to overall supply-demand dynamics, cost pressures, and inventory levels, the calcined soda market outlook for 2025 is pessimistic. Prices are expected to remain range-bound at lower levels, with the average price declining compared to 2024.

Phase Opportunities

Prices may see a rebound during the summer seasonal maintenance period, driven by short-term supply contraction, favorable macro policies, or unexpected inventory restocking from downstream sectors. However, it is important to note that if demand fails to keep pace, any rebound could be followed by renewed downward pressure.

Bottom Detection

The price floor will largely depend on the strength of cost support, specifically the cash costs of both the ammonia-soda and natural calcined soda processes. If prices persist below the cost line, it could force out high-cost production capacity.

4.Conclusion

Buoyed by strong demand from photovoltaic glass, the long-term outlook for soda ash light and dense remains positive. However, short-term caution is warranted due to supply pressure from new capacity. The market’s core driver is shifting from demand to cost, with the price floor increasingly set by the cash costs of high-cost producers, particularly those using the ammonia-soda and dual salt processes.